HSBC Expat

The added complexities of expatriate life mean it’s important to get the basics right. As Lisa Wood, Head of Marketing at HSBC Bank International says in the latest HSBC Expat Explorer Survey: “We’ve found that countries rarely provide the best of both worlds in terms of financial prospects and lifestyle improvements and so it is important for expats to assess what they are hoping to achieve from their move before relocating.”

One of the most important things to get right is your finances, and having the right banking arrangements is a fundamental part of life overseas. For expats, banking services should ideally meet at least two main criteria: flexibility (money should be easy to access and transfer between countries); and be financially secure (in a reputable bank that complies with international financial regulations and has a solid capital base).

Consider an offshore account

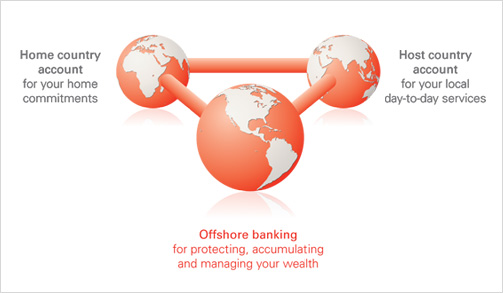

Traditionally, expats might expect to have two bank accounts; your home account for financial commitments at home such as mortgage and utility bill payments and rent collection, and a local bank account in the country where you are living for your salary to be paid into (in local currency) and for day-to-day expenses.

One potential extension of this, however, is to adopt the “home, host, offshore” approach to banking: retaining an account at home, opening one local to your host country but also having an offshore account for savings, investment and wealth management, as well as taking advantage of any potential tax planning opportunities (see the feature on tax).

For most expats, one of the main reasons to open an offshore bank account is because you can grow your savings and investments while taking advantage of these potential tax efficiencies, but there are many others. For instance, banking offshore means your money stays in one location wherever you live or may move to, meaning you can easily access and transfer funds from around the world. It also means you can manage your finances in a number of different currencies, while taking advantage of specialist advice that is likely to be suited to your particular needs and circumstances.

Arrange your finances before you move

Your finances will need a certain amount of planning and yet financial experts say that many expats do not sort out their banking arrangements until they arrive at their new location, only to realise that access to their money isn’t always straightforward. Setting up an account in the country you’ve settled in isn’t without its challenges, particularly in terms of having the right documentation to hand or being able to provide a permanent residential address. And, as Brian Friedman, founder and chief executive officer of the Forum for Expatriate Management, a news and information service for expats, points out: “Getting a credit card, for instance, can be hard as you don’t have a credit history [in the new country].”

One way to avoid the difficulties of opening an account in your host country is to open an offshore account before you leave your home country, thereby ensuring you have easy access to your money when you arrive in your new country. And if you’re using a bank that has global reach, the bank may be able to open a local account in your destination country and transfer your credit history on your behalf before you even arrive.

Speak to the experts

If you are moving with your job, your company may provide specialist help, as Martyn Edney, an HR professional based in Buckinghamshire, south-east England, has discovered. Martyn is soon to move to Madrid, Spain, following a restructuring of his company, but as he plans to return to the UK at some point, he is keeping a UK bank account open to pay for things like mortgage payments on his UK property, which he will let out.

His employer has provided him with access to a relocation advisory company, HCR, to help him with banking arrangements and other aspects of the move overseas. If you don’t have access to such a service, experts advise allowing a month to open an account abroad, although with all the relevant documentation it can be as quick as just 48 hours.

Of course, before making a decision on banking arrangements it is, as always, important to seek advice from a financial expert with experience in expatriate and offshore finances. Long-standing expats should also review their banking arrangements regularly, in order to ensure that their finances are in optimal shape.

The sheer variety of banking services targeted at expats can seem daunting, but a good financial adviser, or bank specialising in expat finance, can offer independent financial advice that’s tailored to your particular circumstances. Experience shows that adding “offshore” to the “home and host” approach to banking can help in certain circumstances, so if you haven’t considered this option, then it might be worth exploring.

This is one of a series of articles from HSBC Expat we’re publishing to help current and future expatraites to manage their finances. This series will contain articles regarding tax, cost of living, family finances and growing your wealth.